Market Vectors-Gold Miners ETF is US First and Only ETF Offering Broad Exposure to Gold-Mining Companies.

NEW YORK--(BUSINESS WIRE)--May 22, 2006--The American Stock Exchange® (Amex®), together with Van Eck Global, today announced the launch of the Market Vectors-Gold Miners ETF (the "Fund"). Now available for trading on the Amex under the ticker symbol GDX, this new exchange-traded fund (ETF) is designed to track the performance of the Amex Gold Miners Index (Amex: GDM - News) and is the first and only exchange-traded fund in the U.S. that offers investors broad exposure to the gold-mining equity market.

The Amex Gold Miners Index currently has 44 constituents, exceeding the scope of any other gold-mining-oriented index. The Index seeks to provide a balanced, diversified approach by including a comprehensive range of small, mid-sized and large companies from around the globe. The Amex Gold Miners Index was created by Amex in 2004 and is back-tested to September 1993.

While there are currently two exchange-traded funds on the market providing direct exposure to gold bullion, the Market Vectors-Gold Miners ETF is the nation's first and only exchange-traded fund to provide exposure to gold-mining shares.

"The American Stock Exchange is delighted to partner with Van Eck Global to bring this exciting new ETF to the marketplace," said Cliff Weber, Senior Vice President of the Amex's ETF marketplace. "Van Eck Global is a respected leader in offering gold-mining investment products, and the Amex is extremely pleased to have been selected to list their first ETF, which is a welcome addition to the Amex family of innovative products."

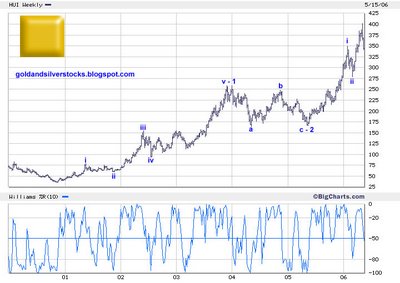

The current bull market in gold is now in its fifth year. "That is an extraordinary milestone," said Joseph Foster, who has been involved in the management of various Van Eck gold funds since 1996. "We at Van Eck believe that the vulnerability of the U.S. dollar, the twin deficits and other financial imbalances could lead to economic stress that supports a continued positive view on gold-related investments. The Market Vectors-Gold Miners ETF is designed for investors looking for the traditional diversification benefits of gold-related investments as well as the liquidity that intra-day trading access provides," Mr. Foster said.

Investors are becoming increasingly aware of the diversification benefits associated with gold and other commodity-related investments. "We believe that financial advisors and their clients will benefit from innovative ways to gain exposure to these markets," said Jan van Eck, Executive Vice President of Van Eck Global. "This new ETF underscores our long-standing commitment to commodity-related asset classes by providing a more diverse range of gold-related investment tools to the financial community."

Who Should Invest in the Market Vectors-Gold Miners ETF?

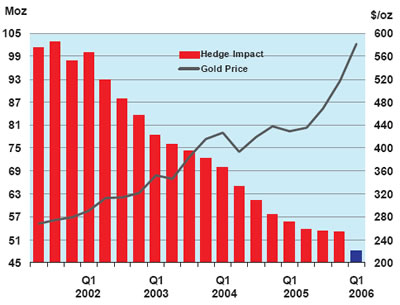

This ETF is designed for investors (institutions, hedge-fund and mutual-fund portfolio managers, as well as individual investors) seeking broad exposure to gold-mining shares. Stocks of gold-mining companies can be an effective way to leverage changes in the price of bullion. The Market Vectors-Gold Miners ETF is suitable for long-term investments; the Fund may also be sold short, thereby acting as a speculative hedging investment.

Van Eck Global is a pioneer and industry leader in commodity-related investment vehicles. Van Eck has been investing globally for more than fifty years and has been managing gold-related investments since 1968, when it introduced the nation's first gold-mining-oriented mutual fund. In addition to the Market Vectors-Gold Miners ETF, the Firm offers gold- and commodity-oriented mutual funds, variable insurance trust funds, institutional accounts and hedge funds.

The specialist for the Market Vectors-Gold Miners ETF is Goldman Sachs Execution & Clearing, L.P.

sourceSee also :

Van Eck Seeks SEC Approval for Gold Shares ETF Gold Market News and charts

Labels: GDM, GDX, Gold