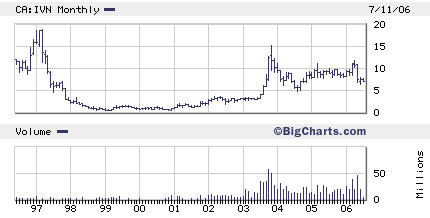

HUI – Gold Bugs Index Technical Update

The HUI is a good proxy for the gold miners. Usually the HUI is outperforming the rest of the gold miners Indices ( XAU, GDM , GOX). Miners which are components of this index tend to have little gold hedge or none, thus providing investors with the full opportunity to enjoy this roaring global gold bull market.

Technically, as noted at my last update, the HUI completed ABC correction wave (wave II – 3), followed by minor up wave ( i- III) and then a minor wave down ( ii – III). Currently The HUI is at the beginning of wave (iii – III) which is part of a larger degree third wave up – This is a triple three wave up and as such it encapsulate a potential for extremely large gains on the upside. This is the time you want to be fully long all good quality things gold and don’t be quick to take profit.

Below is HUI daily chart annotated with 2 sets of Fibonacci retracement lines, pink set from top ( I – 3) to bottom (c- II) and purple set from bottom ( c- II) to minor top (i – III) the HUI is just above the 38.2% on both sets and the 50 DMA – this should provide good support. RSI above 50 , MACD flat above zero.

I repeat, this is the time to be fully long on gold and all of your favorite gold stocks as the potential for massive gains is extremely high in my opinion.

Labels: Elliott Wave, Fibonacci, HUI