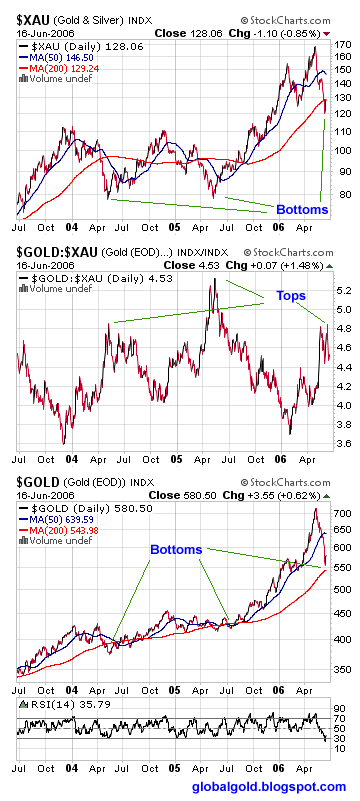

Gold vs. Gold Stocks, GOLD/XAU Ratio

Gold Stocks as a group or an index tend to be more volatile then gold. When gold is going up gold stocks tend to go up faster, when gold is correcting downwards , gold stocks get hit harder. Overall Gold & gold indices are well correlated. This can be easily seen on the first chart below which presents the last 3 year performance of Gold, The Philadelphia Gold & Silver Index (XAU) and the ratio between them. When the Gold / XAU is trending down both Gold & the XAU Index are trending up and visa versa.

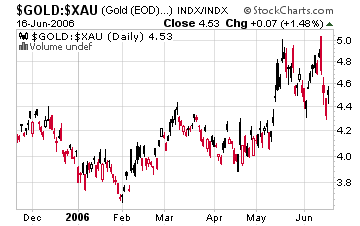

The usefulness in charting the GOLD/XAU ratio is dual – the ratio can sometimes give an early sign and confirmation of bottom or top for the Gold market complex. Looking at the second chart below (Seven month $GOLD:$XAU daily candle chart) you can see a relatively clear double top pattern which implies that the gold market have bottomed.

Please note: The GOLD/XAU Indicator have served me in the past but I do expect it to stop working sometimes in the future - Gold and Silver will outperform the stocks at some point. Remember that gold stocks are highly dependent on the price of gold while the opposite is not true.

I choose the Philadelphia Gold & Silver Index (XAU) for the reason it is the most popular - traded gold stocks index. The same conclusions are generally true for other gold indices like the GDM (GDX ETF) – AMEX Gold Miners Index, the HUI – AMEX Gold Bugs Index and the GOX – CBOE Gold Index.

By the way and In case you wanted to know my favorite gold stock is the GLD.

1 Comments:

I believe that silver is a better buy here than gold.

Post a Comment

<< Home