Cambior posts record profit in 2005Feb. 20, 2006. 06:35 PM

ALLAN SWIFT

CANADIAN PRESS

MONTREAL — Gold miner Cambior Inc. (TSX: CBJ) produced record net earnings in 2005 of $20.2 million (U.S.), a major reversal from the $73.8 million net loss incurred in 2004.

The results, reported in U.S. dollars on Monday, amounted to seven cents per share for the year versus a loss of 30 cents the previous year.

Revenues increased to $368.5 million in comparison to $300.9 million the year before, mainly as a result of higher gold prices and increased revenues from non-gold operations.

The 2005 results include a gain of $12.5 million on the sale of the Carlota project in December 2005, while in 2004, it recorded an impairment charge of $73.1 million for the Doyon mine.

Operating costs were negatively affected by the strength of the Canadian dollar and higher costs for fuel and other consumables such as steel, chemicals and lubricants, as compared to costs prevailing in 2004.

Total gold production reached of 638,400 ounces, produced at a mine operating cost of $285 per ounce. Cambior's gold production target for 2006 is 529,000 ounces at an estimated mine operating cost of $294 per ounce.

For the fourth quarter ended Dec. 31, Cambior realized net earnings of $19.8 million, or seven cents per share, compared to a net loss of $76.7 million, or 28 cents per share, for the same period in 2004.

Revenues for the quarter reached $97.4 million compared to $81.9 million a year earlier. A higher gold price and stronger non-gold revenues more than offset lower gold output.

Gold production for the quarter totalled 141,600 ounces at a mine operating cost of $286 per ounce compared to 175,100 ounces at a mine operating cost of $251 per ounce for the corresponding quarter in 2004. The cost increase is mainly due to higher energy costs.

Chief executive Louis Gignac said the yearly turnaround was fuelled by the new Rosebel mine in Suriname, which increased its production by 25 per cent in 2005, its second year in operation.

This allowed Cambior to surpass the 2005 gold production target by three per cent, despite the closure in September of the depleted Omai gold mine in neighbouring Guyana.

The company's total estimated reserves increased by 42 per cent to reach five million ounces of gold.

Cambior shares closed Monday up three cents to $3.46, before the results were released.

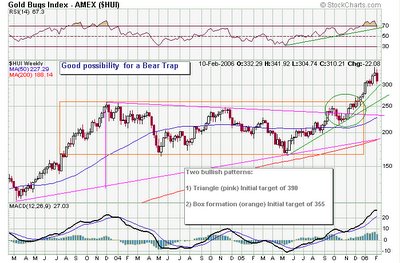

sourceClick on the chart to enlarge:

Profile

Profile Cambior is the sixth largest Canadian gold producer and employs 2,700 talented people at six mines in North and South America. In 2005, we attained gold production of 638,400 ounces, and our 2006 targeted gold production of 529,000 ounces is almost fully exposed to the gold price. The decrease in production planned for 2006 is a result of the termination of production at the Omai mine in September of 2005. In 2006, we will aggressively invest $29 million in the exploration and development of our promising properties in an effort to grow our reserve base. Our mid-term objective is to reach annual gold production of 800,000 ounces and a reserve base of 8 million ounces.

Cambior's shares trade on the Toronto (TSX) and American (AMEX) stock exchanges under the symbol "CBJ". Our warrants (CBJ.WT.C and CBJ.WT.D) trade on the TSX.

Labels: CBJ